Project stage: Complete (Job Market Paper)

[Working paper] [Summary Poster] [Slides] [Estimation of the parametric tax function]

We study implications of progressive pension for designing an optimal progressive income tax code. We use a dynamic general equilibrium overlapping generation model calibrated to Australia where pension payments are universally means-tested to direct benefits toward low income retirees and financed directly by progressive income tax.

Key results:

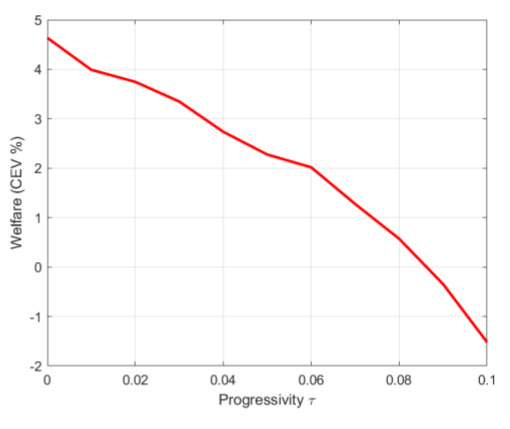

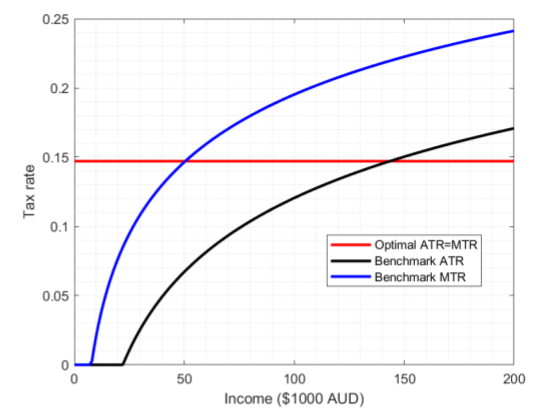

Our analysis indicates that better welfare outcomes are achieved by shifting the social insurance/redistribution role embedded in the income tax system to the means-tested pension system. Reforms that tighten the means-testing rules for pension payments while flattening the progressive income tax code indeed results in overall welfare improvements. The optimal design consists of a flat tax rate and a strict means-tested pension scheme. Our findings also highlight that the effectiveness of a redistributive tax and transfer system can be improved by addressing redistribution concerns directly through more progressive transfers while improving efficiency via reducing tax progressivity.